Contactless card payment Nubank It is a feature that allows you to make purchases in a practical and quick way, without the need to insert the card into the machine and enter the password for amounts below a certain limit.

This technology uses near field communication (NFC) to transmit payment information securely. Although it is convenient, some people have concerns about the security of this feature, especially in situations where the card is lost or stolen.

In this tutorial, we will teach how to activate and deactivate this function so that you have more control over your transactions.

Also read

Nubank bug allowed withdrawals of up to R$1,000 for customers without limit

Nubank announces NuCel, new mobile phone service

What is contactless payment?30

Contactless payment is a technology that uses the NFC (Near Field Communication) to allow the transfer of information between the card and the payment machine, without the need to physically insert it.

This means that, when you bring the card closer to the machine, the transaction is carried out quickly and securely. This functionality is available on debit and credit cards issued by Nubank, and can be used in any establishment that has machines compatible with NFC technology.

The main advantage of contactless payment is practicality, as the payment process is accelerated, making the customer experience more fluid. Furthermore, transactions below a specific value (normally R$200.00) do not require the entry of a password, which speeds up the process even further. However, this feature can also raise security concerns, which is why many users choose to disable this functionality when they do not use it frequently.

How to activate contactless payment on your Nubank card

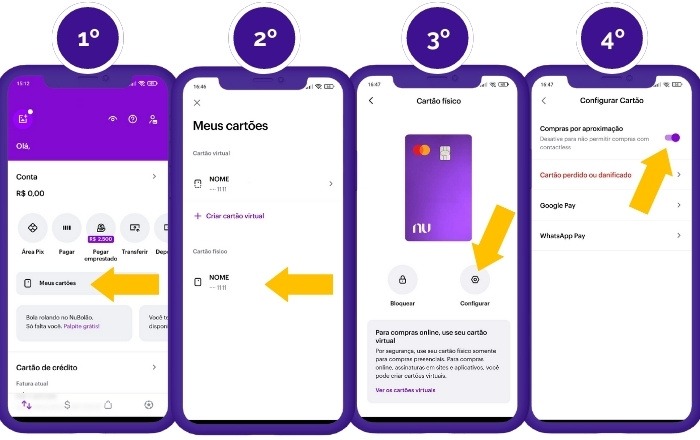

Step by Step:

- Open the Nubank app on your smartphone.

- On the home screen, tap “My Cards“.

- Select the “Physical Card“.

- Tap “Configure“.

- Activate the option “Contactless Shopping“.

By activating this functionality, you will be able to make payments simply by bringing your card to the machine. To ensure security, Nubank requests that the first transaction after activation be carried out by inserting the card into the machine and entering the password, thus definitively activating the contact function.

Observation: For cards issued after 2018, the contactless payment function is already enabled by default. If your card is newer, simply carry out the first transaction using the traditional method for the contactless payment function to be activated.

How to deactivate contactless payment on your Nubank card

Step by Step:

- Open the Nubank app on your smartphone.

- On the home screen, tap “My Cards“.

- Select the “Physical Card“.

- Tap “Configure“.

- Disable the option “Contactless Shopping“.

After deactivating the contactless payment function, all purchases will need to be made by inserting the card into the machine and entering the password, ensuring an additional level of security. This option is ideal for those who prefer to have stricter control over each transaction carried out.

How to activate or deactivate contactless payment on virtual cards via digital wallets

Para Google Pay (Android):

- Open Google Wallet on your smartphone.

- Select the Nubank card you want to manage.

- Tap the three dots icon in the top right corner of the screen.

- Choose the option “Remove payment method” to deactivate the contactless payment function.

Para Apple Pay (iOS):

- Open the Wallet app on your iOS device.

- Select the Nubank card you want to manage.

- Tap the three dots icon in the top right corner of the screen.

- Choose the option “Remove card” to deactivate the contactless payment function.

Observation: To reactivate the contactless payment function, simply add the card to the corresponding digital wallet again, following the configuration instructions available in the application itself.

Security in contactless payments

:strip_icc()/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2018/e/G/AXix8GSkaZuAvf0kdS9g/nubank.jpg)

Nubank and the Mastercard brand have implemented several layers of security to ensure that contactless transactions are safe. Each transaction is protected by encryption, and the maximum amount allowed for passwordless payments is limited, which reduces the risk if your card is lost or stolen.

Furthermore, the user has full control over the functionality, being able to activate or deactivate it at any time through the application. Another important tip is to always pay attention to transaction notifications sent by the Nubank app, which allows you to quickly identify any suspicious activity.

To further increase security, it is recommended to temporarily block the card through the application if you are not using it for an extended period of time. This way, you prevent any transaction from being carried out without your knowledge.

Source: https://www.hardware.com.br/tutoriais/ativar-desativar-aproximacao-cartao-nubank/