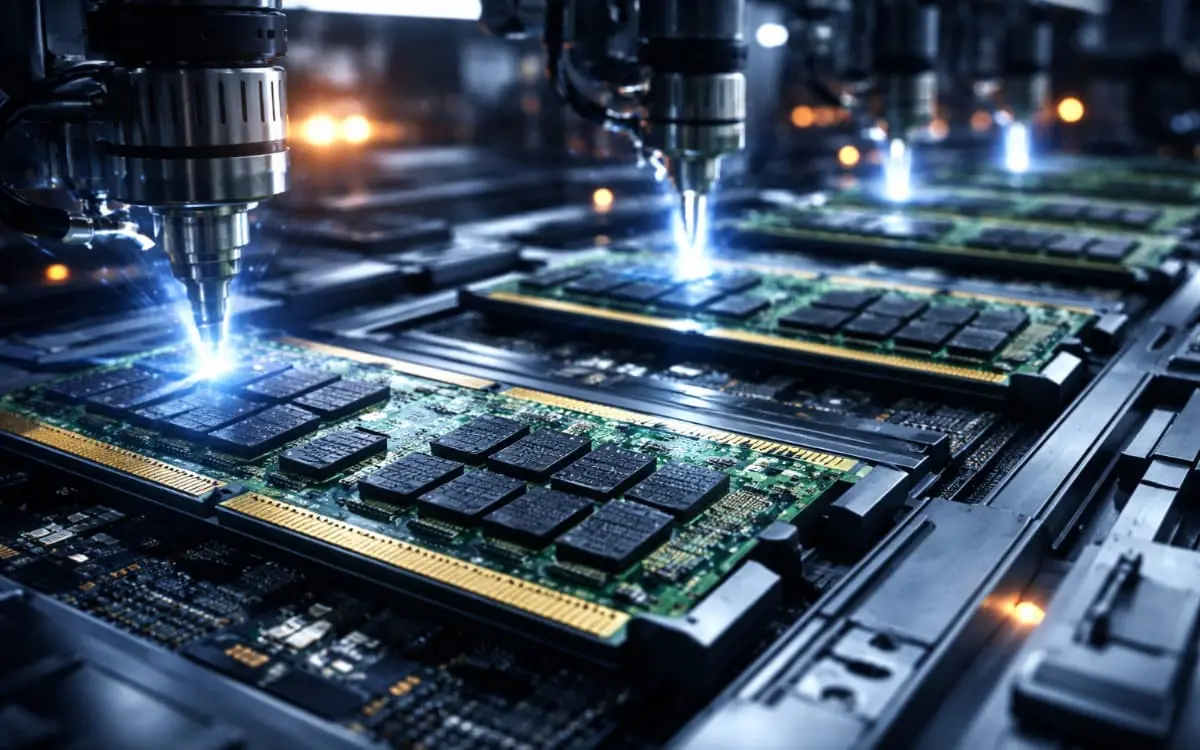

The hardware market dawned with fearsome news that could alter the global supply chain. Howard Lutnick, Secretary of Commerce of the United States, announced that memory manufacturers who do not transfer their production lines to American soil could face a US DRAM rate of 100%.

The aggressive measure goes against the Trump administration’s “Made in USA” narrative, pressuring giants in the sector to invest heavily in local infrastructure or bear fees that would make competitiveness unfeasible.

The declaration took place during the ceremony to begin construction work on the new Micron factory in New York. The ultimatum is clear: either companies build in America, or they pay double to enter the market.

This policy puts immediate pressure on segment leaders, such as South Korean Samsung and SK Hynix, which dominate the global supply of memory for servers, PCs and mobile devices.

The ultimatum for local production

The new tariff policy is the first that the American government specifically targets suppliers of DRAM with such aggressiveness. Lutnick emphasized that “everyone who wants to build memory has two choices: pay a 100% tariff or build in America.”

For a change, the strategy seeks to shield the artificial intelligence sector, which relies massively on high-bandwidth memories (HBM) and high-performance DDR5 modules.

While Micron, the only major U.S.-based manufacturer, is already moving forward with expansions funded by the CHIPS Act, its Asian competitors face a logistical and financial dilemma.

A semiconductor manufacturing requires years of planning and billions in investment, which makes a sudden change in strategy extremely complex

Samsung and SK Hynix situation

Although both Samsung and SK Hynix have announced investments in the United States, the scope of these projects may not be sufficient to avoid the fees.

Samsung has plans for Texas, but the initial focus does not necessarily cover the entire DRAM production cycle required by the new rule.

SK Hynix recently committed US$4 billion (around R$23.6 billion in direct conversion) for a unit in Indiana, but the project is aimed at advanced packaging and R&D, not for manufacturing the memory wafers themselves.

Smaller Taiwanese manufacturers such as Nanya Technology and Winbond also enter the risk zone. If the tariff is applied broadly, these companies would have immense difficulties in maintaining their products competitive in the North American market, directly favoring Micron’s local production and potentially creating a supply imbalance.

Also read:

It will hurt the consumer’s pocket

Passing on costs to the end consumer is the most likely scenario if tariffs come into effect. Experts point out that an increase in DRAM import costs could increase the bill of materials (BoM) of smartphones and computers by up to 25%.

For the PC Gaming enthusiast, this would mean considerably more expensive RAM memory sticks and SSDs, slowing down the upgrade cycle.

Furthermore, demand for components for AI servers is already keeping memory prices at high levels. A 100% tariff would act as a multiplier in this inflationary scenario.

Now the market will pay attention to whether the Asian giants will accelerate their construction plans factories in the USA or whether they will try to negotiate diplomatic exceptions to avoid a collapse in consumer hardware prices in the country and the rest of the world.

Fonte(s): Bloomberg

Join the Adrenaline offer group

Check out the main offers on hardware, components and other electronics that we found online. Video card, motherboard, RAM memory and everything you need to build your PC. By joining our group, you receive daily promotions and have early access to discount coupons.

Join the group and take advantage of promotions

Source: https://www.adrenaline.com.br/hardware/tarifa-100-dram-nand-producao-eua/